Empower Your Retirement: The Smart Means to Acquisition a Reverse Mortgage

As retired life techniques, lots of individuals seek efficient techniques to enhance their economic freedom and well-being. Amongst these strategies, a reverse home mortgage arises as a practical option for property owners aged 62 and older, enabling them to tap right into their home equity without the requirement of regular monthly settlements.

Comprehending Reverse Home Loans

Recognizing reverse home mortgages can be important for home owners seeking economic versatility in retirement. A reverse home mortgage is an economic item that allows eligible home owners, commonly aged 62 and older, to convert a section of their home equity into cash money. Unlike standard home mortgages, where customers make month-to-month payments to a loan provider, reverse mortgages enable house owners to receive payments or a round figure while retaining possession of their home.

The quantity offered with a reverse mortgage depends upon numerous elements, including the homeowner's age, the home's worth, and existing rates of interest. Importantly, the lending does not have actually to be settled till the home owner sells the home, vacates, or passes away.

It is crucial for prospective customers to comprehend the ramifications of this economic item, consisting of the influence on estate inheritance, tax obligation factors to consider, and ongoing duties related to residential or commercial property upkeep, tax obligations, and insurance coverage. Furthermore, counseling sessions with certified specialists are commonly called for to make sure that consumers totally understand the terms of the loan. On the whole, a thorough understanding of reverse home mortgages can encourage house owners to make informed choices regarding their economic future in retirement.

Benefits of a Reverse Home Mortgage

A reverse home loan offers a number of compelling advantages for eligible homeowners, specifically those in retirement. This monetary tool permits elders to convert a part of their home equity into money, supplying vital funds without the requirement for month-to-month mortgage settlements. The cash gotten can be used for numerous purposes, such as covering medical expenses, making home renovations, or supplementing retired life income, hence enhancing total financial flexibility.

One substantial advantage of a reverse home mortgage is that it does not call for repayment till the home owner vacates, markets the home, or passes away - purchase reverse mortgage. This function allows retired people to preserve their way of living and meet unforeseen costs without the worry of regular monthly settlements. Additionally, the funds received are generally tax-free, allowing homeowners to use their money without fear of tax obligation effects

Additionally, a reverse mortgage can supply comfort, recognizing that it can function as a monetary safety net during difficult times. Homeowners additionally keep possession of their homes, ensuring they can proceed living in a familiar environment. Eventually, a reverse home loan can be a strategic funds, encouraging retired people to manage their funds effectively while enjoying their golden years.

The Application Process

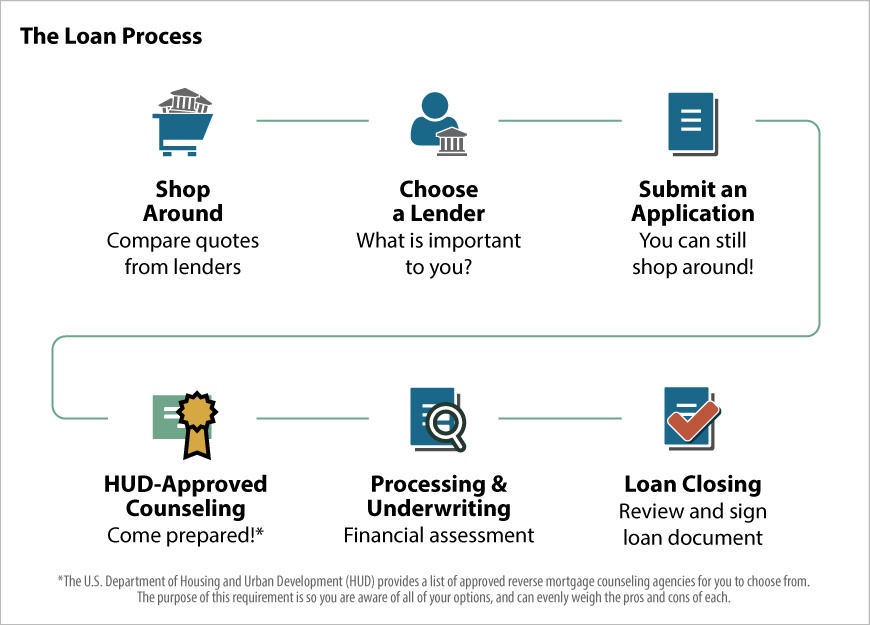

Navigating the application process for a reverse home loan is a vital step for home owners considering this monetary alternative. The very first phase involves evaluating eligibility, which typically requires the house owner to be at the very least 62 years of ages, very own the property outright or have a low home loan equilibrium, and inhabit the home as their main home.

Once eligibility is confirmed, property owners must undergo a therapy session with a HUD-approved counselor. This session ensures that they completely recognize the implications of a reverse mortgage, consisting of the duties entailed. purchase reverse mortgage. After finishing therapy, applicants can continue to gather needed documents, consisting of proof of earnings, possessions, and the home's value

The following action requires submitting an application to a lending institution, that will certainly assess the monetary and residential or commercial property credentials. An appraisal of the home will certainly likewise be performed to determine its market price. If authorized, the loan provider will certainly provide financing terms, which ought to be reviewed have a peek at this website thoroughly.

Upon acceptance, the closing process adheres to, where last papers are authorized, and funds are disbursed. Understanding each phase of this application process can substantially enhance the house owner's self-confidence and decision-making regarding reverse home loans.

Secret Factors To Consider Before Getting

Acquiring a reverse home mortgage is a substantial monetary choice that calls for cautious factor to consider of several vital factors. Examining your monetary needs and goals is equally important; determine whether a reverse home loan lines up with your long-lasting plans.

Moreover, examine the influence on your current lifestyle. A reverse home loan can affect your eligibility for sure federal government advantages, such as Medicaid. Lastly, look for professional support. Consulting with a financial expert or a housing counselor can supply useful insights tailored to your individual situations. By thoroughly assessing these factors to consider, this website you can make a much more enlightened decision concerning whether a reverse home loan is the appropriate economic approach for your retired life.

Making the Many of Your Funds

When you have actually secured a reverse home mortgage, effectively taking care of the funds ends up being a top priority. The versatility of a reverse home mortgage permits homeowners to utilize the funds in different methods, but critical planning is vital to optimize their advantages.

One key method is to create a budget that details your monthly expenditures and financial objectives. By identifying essential expenditures such as medical care, home tax obligations, and home upkeep, you can allocate funds accordingly to make sure long-lasting sustainability. In addition, think about making use of a section of the funds for financial investments that can create income or appreciate with time, such as mutual funds or dividend-paying supplies.

One more essential element is to preserve an emergency situation fund. Reserving a reserve from your reverse mortgage can help cover unexpected prices, providing peace of mind and economic stability. In addition, seek advice from a monetary advisor to discover possible tax implications and just how to integrate reverse mortgage funds right into your general retired life strategy.

Inevitably, sensible monitoring of reverse home loan funds can boost your monetary security, allowing you to enjoy your retirement years without the stress of economic uncertainty. Careful planning and notified decision-making will make certain that your funds function effectively for you.

Final Thought

To conclude, a reverse home mortgage presents a sensible economic method for senior citizens looking for to improve their retirement experience. By converting home equity right into available funds, people can address necessary costs and safe added funds without sustaining regular monthly payments. Mindful consideration of the linked effects and terms is crucial to maximize benefits. Inevitably, leveraging this financial device can promote better independence and improve general quality of life during retirement years.

Understanding reverse home loans can be important for home owners seeking monetary versatility in retired life. A reverse home loan is an economic item that permits eligible house owners, typically aged 62 and older, to transform a section of their home equity right into cash money. Unlike conventional home loans, where customers make monthly settlements to a lender, reverse home mortgages make it possible for house owners to pop over to this site get settlements or a swelling sum while preserving possession of their residential property.

Generally, an extensive understanding of reverse home loans can empower house owners to make enlightened choices concerning their financial future in retired life.

Consult with a monetary advisor to discover feasible tax effects and how to integrate reverse mortgage funds into your overall retired life technique.

Comments on “What You Need to Know Before You Purchase Reverse Mortgage”